7 Predictors to Avoid a Family Cacophony

Cacophony

is an incongruous or chaotic mixture, a striking combination. The antithesis of harmony.

Dissonance

is a tension or clash resulting from the combination of two or more disharmonious or unsuitable elements.

Family harmony and sibling collaboration does not happen without conviction, communication, courage and most importantly an acceptance of both shared family values and valuables. Strong continuity and the realization of familiness[1] is hard work. Avoiding conversations around collective values, capabilities and shared goals will only create the family cacophony you fear.

This concept of the family assets is the starting point for wealth continuity to succeed and family harmony to evolve. If everyone can see the collection of family wealth being the financial and human resources available to achieve personal goals and aspirations, then there is greater motivation to live congruently despite what relational challenges strike along the way.

Baby boomers had it easy over the last 75 years: we experienced minimal hardships or the physicality of labour that our parents did. There were the foundations of education, healthcare and favourable tax structures to support the spirit of renewal to encourage our ambitions. We lived in abundance as we witnessed a movement away from the industrial age to an intellectual one. There were unlimited boundaries and effortless possibilities.

Money and success came with advanced education, hard work and determination. We could not depend on any financial leverage from mom and dad, not that there were any handouts to be had. You were taught to be independent, self-reliant, and able to witness the greatest generational growth of mankind, the result of which is the largest transfer of wealth. This mega transfer creates fear and anxiety for those of wealth, because of their lack of experience in receiving it themselves.

So, the question now is what to do with the wealth, wisdom and influence?

As I see only there are only 3 choices:

- Enhance your lifestyle to elevate your status in the community

- Support future generations on realizing their dreams and aspirations,

- Make a social difference and support your areas of interest through philanthropy.

I believe that Aristotle had it right, “the whole is greater than the sum of its parts” and to facilitate the family harmony we seek, we need to understand our options within the framework of family values, philosophy and the Wealth Manifesto™.

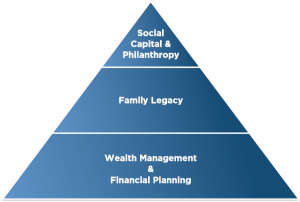

To determine the financial threshold for giving without impacting your own lifestyle requires an understanding of the relationship between financial independence, legacy and social capital. We call this our “Wealth Pyramid.”[2]

Establishing a strong sustainable level of financial security is the foundation of everyone’s financial health. Working through the final stages of our Life Cycle™ of transcendence, we always need to stress test our own financial security against the risk of market volatility or living too long.

Good wealth managers do this scientifically by balancing and rebalancing to minimize the losses and maximize the gains. They will also manage your manic behaviour and stop you from emotionally motivated bad decisions. That means simply living within your means by, regulating cash flow, controlling debt, mitigating risk and thoughtful estate planning with an emphasis on elder care and end of life wishes.

When the Family Manifesto™ is clarified, the Wealth Pyramid is established and the Core Team is selected, the hard work can begin.

How is cacophony avoided?

In my experience every family has its own unique contributing factors to realizing optimum results, but there are consistent factors to those families best able to beat the odds of destructive wealth continuity and dilution of the family brand.

I can quantify these contributing factors in a Predictor Index™.

- Clear family identity (Brand)

- Drive to sustain the family uniqueness (Will)

- Strong governance and decision-making process (Rules)

- Family wealth or assets. (Capital)

- Communication between a core advisory team (Collaboration)

- Regular family meetings of all stakeholders. (Inclusion)

- Direction or purpose (Compass)

Like the answer to how an ambitious musician can perform at Carnegie Hall, practice only works when the artist is also focused, mentored, resourceful, and talented! Family harmony is no different!

It takes a clear understanding of the family vision, values and goals, enriched with both the human and financial resources made accessible by the family to accelerate its collective potential.

[1] Familiness is the specific result of the structural coupling of family and enterprise, which can bring forth a particular identity as a family business that has grown historically and incorporates different content relations such as particular abilities to innovate.

[2] Source: The Legacy Companies™